|

July 2015 Fund and Eclipse changes |

|

|

|

|

July 2015 Fund and Eclipse changes |

|

|

July 2015 Fund and Eclipse changes

This FAQ topic can be downloaded as a PDF (10 pages) by clicking here (or right click > Save link as ...)

Effective July 2015, HCF introduced a new arrangement for known gap claiming, having previously offered only a no gap product. This involved 2 separate fee schedules. Version 7.8 of Access Anaesthetics has introduced a number of changes to accommodate this, and also to improve the management of NO- and KNOWN-GAP accounts, particularly in relation to Eclipse claiming.

HCF Known Gap schedule

HCF will introduce a known gap arrangement effective on 1 July 2015. There will be two separate fee schedules, one for no-gap and one for known-gap, with the known-gap schedule having slightly lower fees.

The differences vary among items and some examples are shown in the table at right. The standard unit rate is $34.70 for no-gap and $33.50 for known-gap.

Item |

Current |

New No Gap |

New Known Gap |

HCF |

HCF |

HCF_KG |

|

23010 (1 time item) |

34.70 |

34.70 |

33.50 |

17610 |

95.00 |

90.30 |

73.00 |

17615 |

141.80 |

142.60 |

135.00 |

18216 |

316.70 |

316.55 |

300.00 |

22012 |

104.10 |

104.15 |

101.00 |

22025 |

138.80 |

138.85 |

134.50 |

If a patient copayment is charged, the known-gap schedule is used. Doctors need to advise HCF whether they wish to be deemed no-gap or known-gap providers, and this is the schedule they will commit to, unless changed with 30 days notice to HCF.

| • | If the known-gap arrangement is selected, and the doctor decides in an individual case not to charge a gap, they must still use the known-gap schedule. |

| • | Doctors who use the no-gap schedule are not able to charge a patient copayment. |

| • | If a doctor does not nominate a preference before July 1, HCF will designate him as a known-gap provider. More information is available on the HCF Provider website. |

In Access Anaesthetics, there will be two HCF schedules.

| • | The no-gap schedule will be called HCF, as it is now. |

| • | The new known-gap schedule will be called HCF_KG. |

Both will appear in the list of fee schedules and will be selectable on the Items page. They will only be visible for accounts where the operation date is July 1 or later.

Saving your schedule preference.

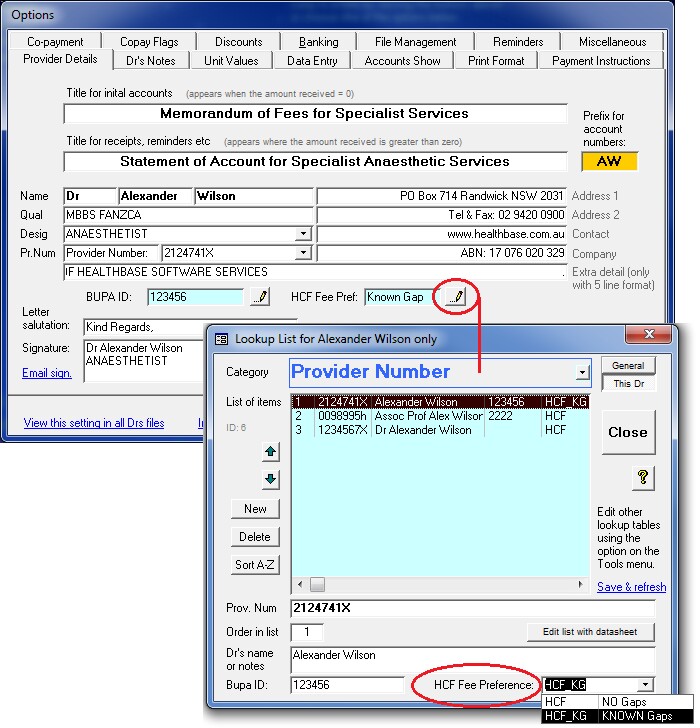

An individual doctor can save his preference for one or other schedule in the Options form as shown in the image at right.

This means that when HCF is chosen as the fund, the correct schedule (HCF or HCF_KG) will be inserted automatically on the Items page.

The schedule preference will be stored along with the provider number. This is so that, if required, a doctor can have a different preference for each provider number they use.

As before, the fee schedule for an individual account can be changed on the Items page, although it is not anticipated that this would normally be required, except where fund membership details have been changed after the items were added.

Default schedule

If an HCF account is created without a fee preference having been recorded, you will be prompted to add one. Since HCF will automatically assign doctors to the Known Gap schedule if they have not notified them of a preference, AA will also do this and assign the HCF_KG fee by default.

Changes on the Items page

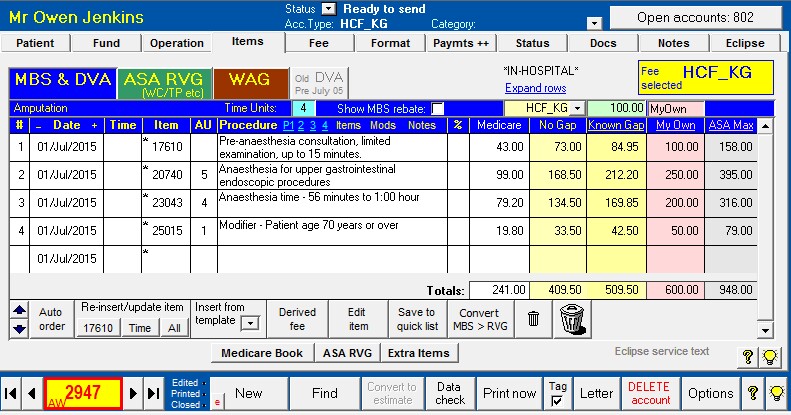

The Items page has 2 new columns. These are the Known Gap fee and the ASA Max fee, as shown in the image below.

ASA Max fee

The ASA Max fee is added for your convenience when determining fees, and particularly copayments.

The ASA Max fee is calculated automatically when items are entered using the RVG unit value multiplied by the maximum ASA recommended unit rate applicable on the date of service. If the item has no RVG unit value, the fee can't be determined. This column displays what is commonly referred to as the 'AMA fee', and can be seen on the far right in the image below.

A complete list of AMA fees is not included in AA as the AMA will only provide this to individual AMA members. If the ASA Max fee has not been calculated (which will be the case for accounts existing prior to the update), clicking the ASA Max heading provides the option to calculate this for the current account. The total AMA Max fee (shown below the column) can be used as a field code (#AM) in form letters and estimates as required.

Procedure column

The additional 2 columns take up space that was previously used by the Procedure column. The procedure column can be expanded (and contracted) by clicking the word 'Procedure'.

The premed shortcuts and 'Quick lists' for Items, Modifiers and Notes have shrunk slightly, but are still functional by clicking on the text labels to the right of the Procedure heading.

Eclipse Copayment transmissions

From version 7.8, copayments added to health fund accounts will automatically be transmitted in all online claims. This is to comply with terms and conditions of the health funds' gapcover products. Previously, only the no-gap fee was transmitted in electronic claims, whether or not a copayment was added to the account. It is possible to turn off this feature and have AA continue to transmit no-gap fees even where there is a copayment. This is explained in more detail below under the heading 'Setting copayment preferences'.

Because there is no data element in the online claiming process to transmit a single copayment amount, the total copayment must be distributed across the existing items. Each item will therefore have a known-gap fee, consisting of the no-gap fee, plus a copayment amount. When a copayment is added in AA, it will automatically be distributed across the items, added to the no-gaps fee, and stored in a new field, the KnownGapFee. This is the fee transmitted in an online claim.

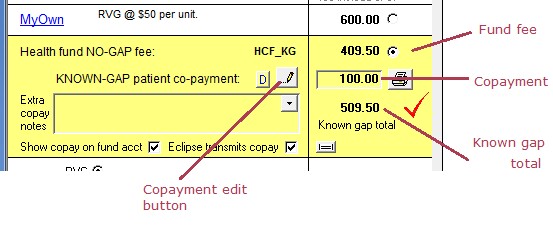

Until now, a copayment could only be added as a single figure on the Fee page. From version 7.8, this can still be done, but other calculation methods are also available.

| • | As before, the copayment can be specified as a total figure by typing into the copayment box on the Fee page. |

| • | The total Known Gap Fee will be shown by adding the copayment to the no-gaps fee. |

| • | Click the edit button provided to open the copayment editing popup window that allows additional calculation methods. |

| • | The window can also be opened by double clicking on the copayment or known gap total amounts. |

Copayment editing window

Editing options include the following

| • | Enter a specific copayment amount in the green 'Co-payment' box. |

| • | Enter a total known-gap amount (fund plus copayment) in the yellow box at the right. |

| • | Click any of the numbered buttons on the left to quickly insert the specified amount as a copayment. |

| • | Enter a dollars/unit figure to be used as the the total known-gap amount. |

| • | Copy the MyOwn fee as the known-gap amount. This is the same process as the small button on the Fee page where the difference between the MyOwn fee and the fund fee was calculated as the copayment. |

| • | Copy the ASA Max fee as the known-gap amount. |

The known-gap fee for each item is shown in a separate column on the Items page.

The copayment editing window can also be opened on the Items page by clicking the 'Known Gap' column heading.

While the dialog box is open, click on the 'Known Gap' heading again to toggle the display of the Known Gap amount (yellow) and the Copayment amount (green), for each item. The large image of the Items page above shows the same screen with the total Known Gap amount visible.

Distributing the copayment across the items

As mentioned previously, the total copayment amount must be transmitted in the fee field for the individual items.

If all items on the account have a unit value, the individual item fees are distributed according to the unit value. Each item is given the value of the total copayment, divided by the proportion of total units. That is, fee = total copayment x (item units / total units). The copayment amount is added to the fund fee to arrive at the Known Gap Fee for each item.

If there are one or more items with no unit value, the copayment is spread across the items in the same proportion as the Medicare schedule fee. That is, fee = total copayment x (item Medicare fee / total Medicare fee).

The copayment should be specified after all the items have been added, and the fund fee selected. When adding/deleting items or changing times after a copayment has been specified, the copayment amount will be kept constant, and the individual item fees adjusted as described above.

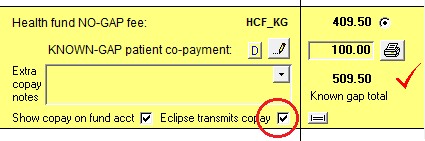

Where it exists, the known gap fee is transmitted in an Eclipse claim, instead of the health fund no-gaps fee. To transmit the no-gap fee only, either the copayment must be removed, or you must clear the checkbox on the Fee page labeled 'Eclipse transmit's copay'. (See below for defaults on transmitting the copayment.)

Specifying copayments for individual items

There will be times when it is preferable to specify the copayment/known-gap amount for individual items separately. This can be done by typing directly into either the Known Gap or Copayment fee columns on the Items page (the copayment fees are visible after using the toggle button).

| • | Known-gap fees (fund + copayment) can be directly edited on the Items page column. |

| • | To edit the copayment amount, type into the copayment field to pop up a dialog box that allows the fee to be entered. |

| • | If the copayment field (green) is not visible, click the column heading labeled 'Known gap'. This will toggle the copayment and known gap fields. |

If individual known-gap or copayment fees are added in this way, AA will add up the existing copayments for each item to calculate a new total copayment. Further fee editing may be done by editing individual item fees, but you should avoid changing the copayment or known gap totals using other methods. This is because entering the total amounts will force AA to recalculate all the fees for the individual items as described above, including the manually entered item values.

Discounts

As before, discounts added to accounts containing copayments will be subtracted from the copayment amount, not from the fund amount. The discounted copayment fee will be transmitted in an online claim, not the undiscounted fee. The discounted copayment is shown in the green field on the Items tab. When the copayment is adjusted using any of the methods above, after a discount has been applied, the discount amount will remain unchanged and the other values will be adjusted accordingly.

Some funds request that information about discounts is included on accounts. However, with only one fee field to use, we have elected to transfer the discounted copayment, since this is normally the full fee that the patient will pay. If a discount is removed (or automatically expires) after an electronic claim is transmitted, the individual item fees will be recalculated, and will no longer reflect the fees transmitted in the claim. This should be considered when adjusting discounts after transmitting claims.

If a discount is removed from a copayment (manually or automatically), the individual items fees are recalculated and the copayment may no longer comply with the health fund's maximum gap rules. Be careful with this, as it may not be noticed that the copayment has been adjusted and may no longer comply with the rules.

Data checking

Different funds have different rules regarding the copayment amount that can be charged when their gap-cover rate is used. AA will warn if an inappropriate total copayment is specified, but will not prevent it being used. As of July 2015, the maximum copayments allowed are $500 for BUPA, MP and HCF for an episode of treatment.

For AHSA funds, the individual item fee cannot be greater than the 'AMA rate' for that item, and up to a maximum of $400 per item. AA will review this, and warn you if the fee for any item is too high. In this case, you should either adjust the total copayment and review the individual items again, or manually adjust the item fees to enter specific values. Note that AA can only check this for items that have a unit value, since the AMA fees for other items are not included in AA. Also, if the ASA Max fees have not been calculated, AA will be unable to perform this check. You can (re)calculate the AMA Max fees for any account by clicking the AMA Max column heading. The standard data check has been updated to apply these rules so a warning will be given before printing or transmitting an account.

As discussed, tor Eclipse IMC claims, if there is a copayment set, the known gap fee on the Items tab will be transmitted. If there is no copayment, the fund fee will be transmitted. In previous versions of AA, the fund fee was transmitted for all Eclipse claims, whether or not a copayment was set. If any of the individual item known gap fees are zero, a warning is given and the claim can't be created. To correct this, re-enter the copayment amount and review the individual item known gap fees.

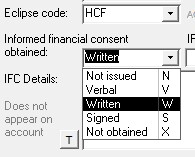

Written IFC issues

In AA, if a copayment is set, the IMC claim type defaults to 'Scheme'. If there is no copayment, the type defaults to 'Agreement'. For Scheme claims, the IFC code must be either Written (W) or Not obtained (X). For Agreement claims (no-gap), the IFC code can be W, X or Verbal (V).

In all accounts, unless an estimate has been issued, the IFC code will default to Not Obtained (X). (The Signed (S) code is an AA code only, which translates to W for Eclipse purposes.) It is possible that a practice may routinely leave the default at X, while charging a copayment. The claim is then transmitted with the X code.

In the past AA has not included any rules or data checks about this. Since only the fund fee was transmitted in the claim, the requirement for the W code was essentially bypassed.

From version 7.8, when the copayment fee is transmitted via Eclipse, it is possible that the gapcover fee may be rejected if the IFC code is not set to W. At present it is unclear if this is the case, and whether it will vary from fund to fund. A data check warning has been added to AA to alert you to the existence of a copayment without a W code. AA will still allow such an account to be sent as an online claim but it is possible that these will be rejected or paid at the Medicare schedule fee rate. From version 7.84 the warning was downgraded to an advisory note only, and will appear when the <Data check> button is clicked, but not automatically before an account is printed or transmitted.

Some funds specifically state in their billing guidelines that written IFC is required for known gap accounts (e.g. AHSA, MP). Others mention the requirement for IFC, but don't specifically mention 'written' (e.g. Bupa, HCF). Bupa is different to other funds as well in that they only accept 'Agreement' claims for Eclipse, and these have the additional IFC option of 'Verbal'.

The issue of what constitutes appropriate IFC is one for the individual provider. Clearly a written estimate is the gold standard, but other methods of providing the patient with written information on likely gaps can also constitute the appropriate consent. The method by which the individual doctor or practice obtains IFC is a matter for the practice to determine when deciding whether to set the IFC flag to W. Some health funds provide advice in their documentation about obtaining IFC. A list of links to health funds websites is given below. Useful advice on obtaining IFC is also provided in the following documents - ASA Position Statement on IFC and AMA Position Statement on IFC.

Where a known gap account is raised, in some circumstances it might be advisable to delay sending the copayment account until the fund has paid their benefit, in case the benefit is less than the full gap-cover amount. The patient can then be given an account with the appropriate adjustments.

Note on other IFC fields. Only the IFC field noted above has any relevance for Eclipse claims or printed accounts. The IFC Status and IFC Details fields are for user's information only and are not transmitted in claims or printed on accounts. When estimates are printed, notes are inserted into these fields to identify the details of the estimate. Manual notes may also be added here.

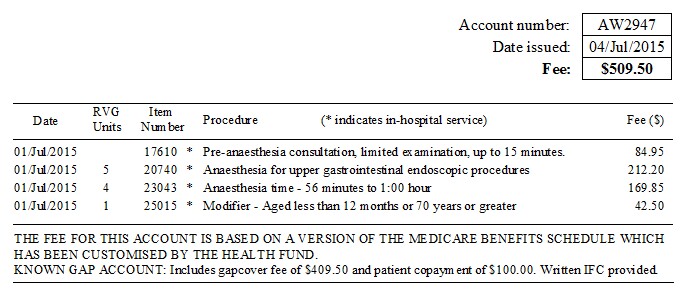

Changes to printed accounts

Itemised copayments.

From version 7.8, when printing an account to send to a health fund that includes a copayment, by default, accounts will print the itemised KNOWN gap amounts for each item. Additionally, the total KNOWN gap amount will appear as the account total. A separate note will state that the account is a Known Gap Account and will give the total fund and copayment amounts, as shown below.

Previously, only the NO gap item fees and total would be shown on the account, and a separate note was shown explaining that an additional specified amount was invoiced separately to the patient. It is possible to change your preference for these 2 display methods by selecting an option in the Options form > Copay Flags page, see below option 5.

Payments.

Previously, payments that were flagged as copayment payments, did not appear on the fund invoice. Rather they appeared only on the copayment invoice. Similarly, payments that were not flagged as copayment payments, would appear on the fund account, but not on the copayment account. With the update, if a fund account has been printed to include the copayment, any payments flagged as copayment payments will also appear on the fund account. Also note ..

| • | If the checkbox 'Show copay on fund acct' is unticked for any individual account, neither the copayment, nor any copayment payments will appear on the account. |

| • | If printing a copayment account, as before, only copayment payments will appear. |

The purpose of this is to allow the fund invoice to be adjusted to be sent to the patient, in case it is required to invoice the patient for any amount that is left outstanding by a fund underpayment. For example, if the fund pays only the Medicare schedule benefit for a procedure, the known gap 'fund' invoice could be readdressed to the patient so the patient could be invoiced for the balance owing. In this case, if the patient has already made a 'gap' payment, this will also appear on the account, and the total will be adjusted so that the patient is invoiced for the balance of the account that has not already been paid by the fund or the patient.

Misc.

| • | If the IFC code W or S is selected, the note 'Written IFC provided' will appear on the 'fund' account, just after the Known Gap message. |

| • | If a 'fund' invoice is sent to the patient, the known gap message is omitted. |

| • | When printing a 'fund' known gap invoice, unlike an Eclipse claim, the written IFC warning is not applied. |

Copayment invoice

There have been no changes to the printed account that is sent to the patient as the copayment invoice.

Changes to IMC processing reports

| • | The IMC processing report gives a comment about the claim outcome. |

| • | The IMC processing report has always shown the fees transmitted in the claim. Where a Known Gap Fee is transmitted, this will be the fee shown. |

Changes to estimates

| • | Estimates for known gap (fund + copayment) accounts are now able to used the itemised fee format. Previously since the individual item fees showed only no-gap amounts, this was not possible. |

| • | If the known gap schedule, HCF_KG is entered, this is treated as known-gap fund for the purpose of calculating expected rebates. |

Field codes for letters and estimates

| • | Where individual item field codes are used for known-gap accounts, these will show the individual known gap fees, rather than the no-gap fees. This is provided that the appropriate option checkboxes are set to show these. |

| • | A new field code has been added to show the total 'ASA Max' fee for the account (#AM). |

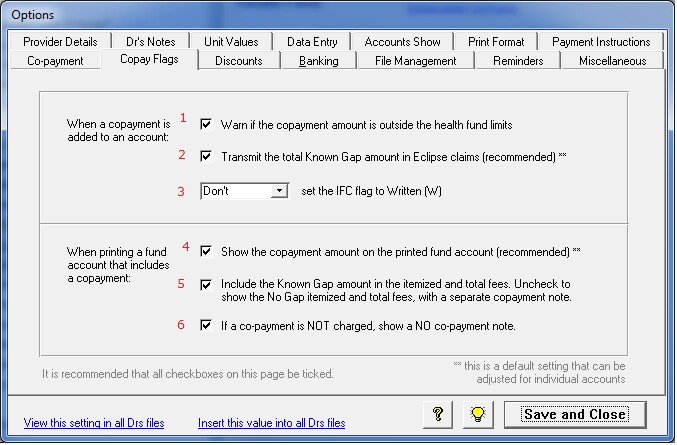

Setting copayment preferences

There are several new configurable options when dealing with copayments in Access Anaesthetics. These can be set differently for each doctor in the practice, and are shown in the Options form on the 'Copay Flags' page. The number 1 - 6 in the image below are just for the purpose of explanation in this text. Options 1, 2, 3, and 5 are new in this version. Initial settings for the new checkboxes are that they are ticked. We recommend that all checkboxes on this page be ticked.

1. Warnings.

Select this option to have AA warn you if a copayment is outside the limits set by the fund. For BUPA, HCF and MP, this is a maximum of $500 per episode of care. For AHSA funds, the maximum is the AMA fee for each item, as long as the copayment amount is not greater than $400 for any individual item. This check will also warn you if you try to add a copayment to a fund that does not have a known gap arrangement, for example, NIB, DVA, ADF, WC etc. Warnings will prompt you with message, but will not prevent you from adding a payment outside the limits.

2. Copayment transmissions.

When an Eclipse claim is created from an account that includes a copayment, the total known gap fee for each item will be transmitted in the claim. If you clear this setting, only the no-gap fee will be transmitted. For most of the health funds, transmitting the full known gap fee is a condition of use of their gapcover schedules.

This setting is the default for new accounts. It is possible to change the preference for individual accounts on the Fee tab. To do this, adjust the checkbox labeled 'Eclipse transmits copay'. If you clear the checkbox on the Fee page, a brief message will flash up. The data check will give a mild warning (only appears if <Data check> button manually clicked) if this box is cleared while the box in the Options is ticked.

If you clear this checkbox, no copayment fees will be transmitted via Eclipse and you will not be warned about the W IFC flag, see below.

3. Setting Written IFC flag.

When a copayment is sent via Eclipse, it is necessary to set the IFC flag to W (written). The IFC flag is shown on the Fund tab for each account, as shown at right.

Failure to select W may see the claim paid at the Medicare schedule fee rate rather than the gapcover rate. Note that in AA there is also an S option (for Signed). This is an AA code only, and translates to W for Eclipse claiming.

When a copayment is entered, the setup options here do the following...

|

|

AA will warn you if you try to send an Eclipse known gap claim without setting the IFC flag to W (unless you have turned off the copayment transmissions as described above.)

4. Show copayment on fund account.

This option has always been available in AA, showing on the Fee tab. This is an additional default option that works the same way, but allow a global setting for each doctor, that can be changed for individual accounts. If affects printed standard accounts only.

5. Itemise known gap amounts.

This setting will itemise the KNOWN gap fees on printed accounts, and show the total KNOWN gap amount as the total account fee. Unchecking this box will itemise the NO gap fees, show the total NO gap amount as the total account fee, and display a note further down the page explaining that an additional copayment fee has been charged separately to the patient. This is how the copayment amounts were always displayed on AA printed accounts prior to the version 7.8 update. This setting will not have any effect if you have selected to not show the copayment on the account (either in 4 above, or by setting on the individual account).

6. No-copayment note.

If the account does not have a copayment added, this setting will display a note on the account explaining that no separate copayment has been charged. Like setting 4, this is not a new setting.

This FAQ topic can be downloaded as a PDF (10 pages) by clicking here (or right click > Save link as ...)

For additional information on gapcover, please review the billing guidelines of each health fund. Links to the funds' websites are given here.